Recently, the web has been plastered with articles about GoPuff, a new delivery service. Upon taking a look at their website, it seems that nothing really distinguishes this company from many others, who are similar, like DoorDash. DoorDash, by the way, still has not shown a single profitable quarter, yet has a market cap of over $56 billion, more than Ford (!), a company with factories, assets and actual profits!

Flamestorm Research has reached out to GoPuff to confirm the company’s valuation and investment amounts. We asked GoPuff for documents or specific proof that the company is valued at $15 billion or that it raised over $1 billion in funding. GoPuff has not responded to any of our inquiries.

GoPuff’s valuation and website raises red flags. The company’s contact page doesn’t even have an address, phone number or email. Upon some research, we came across some information regarding the corporation behind GoPuff here.

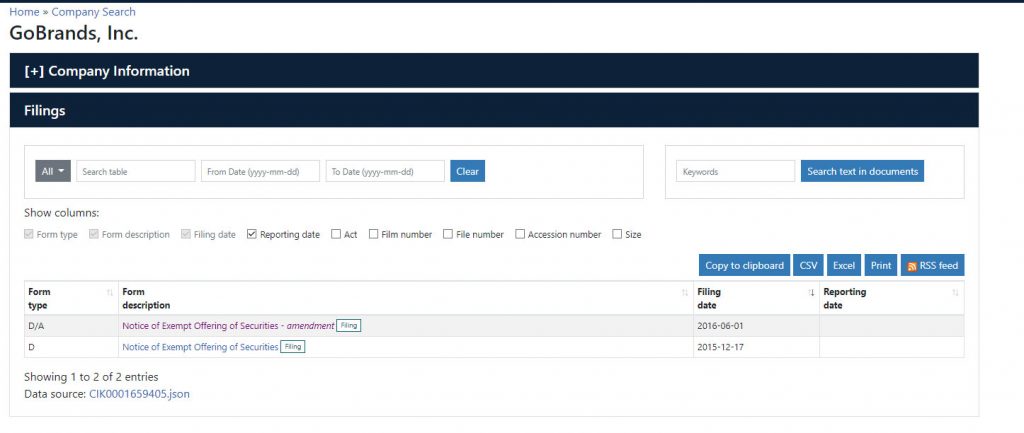

However, no actual proof of the $1 billion investment could be found by search SEC statement records go Go Brands Inc, the corporation behind Go Puff. The SEC search revealed only two documents – notices of exempt offerings – for $3.2M and for $8.2M.

Edgar search did not produce any results for Go Brands Inc.

Based on the fact that we could not obtain any sort of proof of the investment and valuation claims that were widely circulated in the press, we urge investors to proceed with caution. The fact that another cookie cutter delivery app is valued at over $15 billion is ridiculous, to say the least. We are not sure what proof the larger media companies specifically saw before publishing such information all over the internet, besides a press release from the company itself.

Regarding the recent press that the company has received, this could be the result of paid press release services, such as PR Newswire and Businesswire, which publish unverified information for a fee, which is then carried by major media outlets via paid agreements with wire services.